Oil Prices and the Canadian Dollar: A Symbiotic Relationship

The symbiotic relationship between oil prices and the Canadian Dollar (CAD) stands as a testament to the intricate connections woven within the global economic fabric. As one of the world’s leading oil exporters, Canada’s economic landscape is deeply entwined with the fluctuations of oil prices. In this comprehensive exploration, we delve into the symbiotic dance between oil prices and the Canadian Dollar, unraveling the multifaceted dynamics that define their interconnected journey.

The Foundation of Canada’s Resource Economy

The Significance of Oil in Canada:

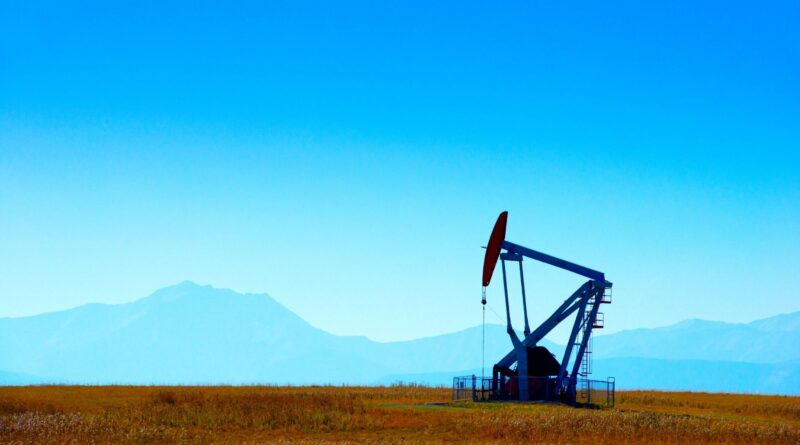

Canada’s vast natural resources, including abundant oil reserves, have played a pivotal role in shaping the nation’s economic identity. The development of the oil sector, particularly in provinces like Alberta, has positioned Canada as a major player in the global oil market. The symbiosis between oil production and the Canadian economy is foundational, with the fortunes of both intricately linked.

The Emergence of Petro-Currency Dynamics:

As Canada solidified its position as a significant oil exporter, the Canadian Dollar became increasingly influenced by the dynamics of the oil market. The term “petro-currency” emerged, signifying the close correlation between the CAD and oil prices. Understanding this interdependence requires an exploration of how oil prices impact the Canadian Dollar’s valuation.

The Impact of Oil Prices on the Canadian Dollar

Economic Contributions of the Oil Sector:

The oil sector’s contributions to Canada’s GDP are substantial, and the revenues generated from oil exports have a direct impact on the nation’s economic health. When oil prices are high, the influx of revenue positively influences Canada’s trade balance, government finances, and overall economic stability.

Trade Balances and Current Account Dynamics:

Oil exports significantly contribute to Canada’s trade balance, and fluctuations in oil prices directly affect the country’s current account. During periods of high oil prices, Canada experiences trade surpluses, leading to increased demand for the Canadian Dollar in the foreign exchange market. Conversely, low oil prices may contribute to trade deficits and impact the Canadian Dollar’s valuation.

Currency Valuation and Exchange Rates

The Link Between Oil Prices and the Canadian Dollar’s Value:

Oil prices exert a profound influence on the Canadian Dollar’s value in the global currency market. The Canadian Dollar tends to strengthen when oil prices rise, reflecting the positive economic impact of increased oil revenues. Conversely, a decline in oil prices can lead to depreciation, as the economic outlook weakens.

Exchange Rate Dynamics:

The relationship between oil prices and the Canadian Dollar is intricately tied to exchange rate dynamics. Investors and traders closely monitor oil price movements as an indicator of the Canadian Dollar’s future performance. Understanding the nuances of this relationship provides insights into potential trends in the foreign exchange market.

Macroeconomic Implications and Fiscal Policy

Macroeconomic Stability:

High oil prices contribute to macroeconomic stability in Canada, fostering economic growth, job creation, and increased government revenue. The positive impact on the Canadian Dollar extends beyond the foreign exchange market, influencing broader economic indicators.

Fiscal Policy Challenges during Oil Price Volatility:

While high oil prices bring economic benefits, the volatility inherent in the oil market poses challenges for fiscal policy. Sharp declines in oil prices can strain government finances, impacting budgetary planning and potentially leading to economic uncertainties that reverberate through the Canadian Dollar.

External Factors and Global Market Dynamics

Geopolitical Events and Oil Price Fluctuations:

Geopolitical events, including conflicts in oil-producing regions or changes in global oil supply and demand, can cause sudden fluctuations in oil prices. These external factors introduce an element of unpredictability that influences both the Canadian economy and the Canadian Dollar.

Global Economic Conditions:

The global economic landscape also plays a crucial role in shaping oil prices and, consequently, the Canadian Dollar. Economic downturns or recessions on a global scale can lead to decreased demand for oil, impacting prices and influencing Canada’s economic outlook.

In conclusion, the symbiotic relationship between oil prices and the Canadian Dollar is a dynamic and multifaceted connection that defines Canada’s economic journey. As a petro-currency, the Canadian Dollar is deeply influenced by the fortunes of the oil sector, reflecting the nation’s reliance on natural resources. The fluctuations in oil prices send ripples through the Canadian economy, impacting trade balances, fiscal policies, and exchange rates. Understanding this intricate dance provides a nuanced perspective on the economic interdependencies that characterize Canada’s position in the global market. As both oil prices and the Canadian Dollar continue their journey through the twists and turns of the global economy, their symbiotic relationship remains a captivating narrative within the broader story of Canada’s economic landscape.