How To Improve Credit Score Quickly

A good credit score is essential for financial health. It impacts everything from loan approvals to interest rates, and can even affect your ability to secure housing or insurance. If you’re looking to improve your credit score quickly, there are effective strategies you can implement. Whether you’re planning to apply for a loan, buy a home, or just want to boost your financial standing, improving your credit score is a crucial step. In this article, we’ll explore proven methods on how to improve your credit score quickly and provide tips for long-term financial success.

What Is a Credit Score?

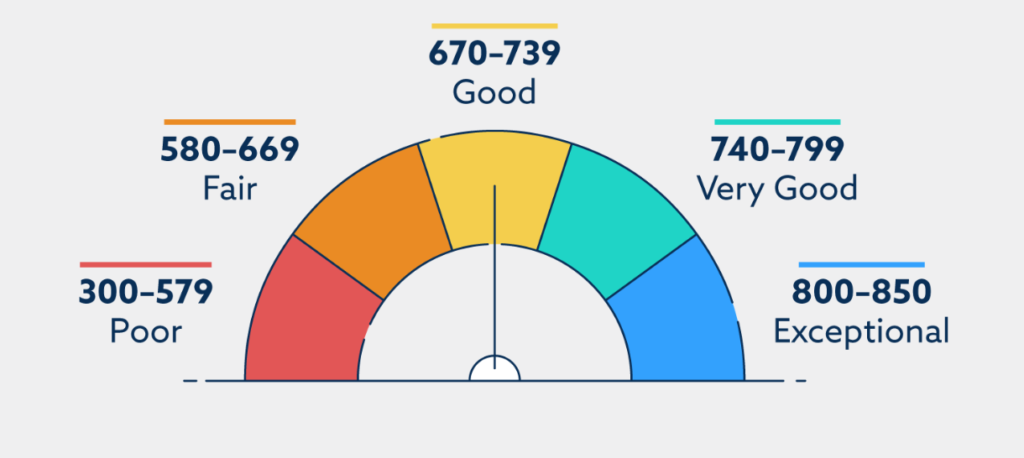

Before diving into the methods of improving your credit score, it’s important to understand what it is and how it’s calculated. A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. The higher the score, the more trustworthy you appear to lenders.

Here are the general ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

Your credit score is determined by several factors, with the following weighted percentages:

- Payment history (35%): Timely payments on loans, credit cards, etc.

- Credit utilization (30%): The percentage of available credit you’re using.

- Length of credit history (15%): How long you’ve been using credit.

- Credit mix (10%): Types of credit accounts you have.

- New credit inquiries (10%): Number of recent hard inquiries on your credit report.

1. Pay Your Bills On Time

The most important factor influencing your credit score is your payment history, making up 35% of the total score. Late payments, missed bills, or defaults can severely damage your score. To improve your credit score quickly, ensure that all bills — including credit cards, utilities, and loans — are paid on time.

Tips for on-time payments:

- Set up reminders or automate payments to avoid missing due dates.

- Pay more than the minimum amount when possible to reduce balances faster.

- Consider using a budgeting app to track your bills and payments.

2. Pay Down Credit Card Balances

Credit utilization, which refers to how much of your available credit you’re using, accounts for 30% of your credit score. A high utilization rate can hurt your score, so reducing your credit card balances is a fast way to boost your score. Aim to use less than 30% of your available credit, ideally keeping it below 10% for the best results.

Quick credit utilization tips:

- Focus on paying down high-interest credit cards first.

- If you have multiple cards, consider consolidating your debt with a balance transfer card offering a 0% APR for an introductory period.

- Avoid accumulating new debt during this period.

3. Dispute Any Errors on Your Credit Report

Mistakes on your credit report can harm your credit score, so it’s essential to check your credit regularly. Errors like incorrectly reported missed payments, duplicate accounts, or accounts that are not yours can drag down your score. By disputing these errors, you can quickly improve your credit score.

Steps to dispute errors:

- Obtain a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) at least once a year.

- Identify any inaccuracies or discrepancies on your report.

- Dispute the errors directly with the credit bureau, either online or via mail.

- Provide supporting documentation, if available.

4. Increase Your Credit Limit

One way to lower your credit utilization rate (and thus improve your credit score) is by requesting a credit limit increase. A higher credit limit means that, for the same balance, your credit utilization will decrease. This strategy can give your credit score a quick boost, but be careful not to increase your spending when your limit is raised.

How to request a credit limit increase:

- Call your credit card issuer or request an increase online through your account.

- If your financial situation has improved, such as a raise at work or paying down debt, mention that to increase your chances of approval.

- Avoid making any large purchases after the increase to maintain a low credit utilization ratio.

5. Become an Authorized User

If you have a family member or close friend with a good credit history, you can ask to be added as an authorized user on their credit card. As an authorized user, the positive payment history from that card will appear on your credit report, potentially improving your score.

Benefits of being an authorized user:

- The primary cardholder’s on-time payments will reflect positively on your credit.

- You won’t be responsible for the debt, but you get the credit-building benefits.

- It’s a fast and easy way to boost your credit score without needing to take on additional debt.

6. Avoid Opening New Credit Accounts

While it might be tempting to open new credit accounts to increase your credit mix or available credit, doing so can actually hurt your credit score in the short term. Each time you apply for a new credit card, a hard inquiry is made on your credit report, which can cause a temporary drop in your score.

Tips for managing new credit inquiries:

- Only apply for new credit when necessary, such as for a specific financial need.

- If you need new credit, consider options that won’t impact your score, like a soft inquiry or a pre-qualification process.

7. Consider a Credit-Builder Loan

If you have a limited or poor credit history, taking out a credit-builder loan can help improve your credit score. These loans are designed for individuals with little to no credit or those trying to rebuild their score. With a credit-builder loan, you borrow a small amount of money that is held in a savings account while you make regular payments. Once the loan is paid off, the money is released to you, and your positive payment history is reported to the credit bureaus.

Why consider a credit-builder loan?

- It helps establish a positive credit history.

- It’s an ideal option for those with no credit or a low credit score.

- The loan payments are reported to credit bureaus, boosting your score.

Improving your credit score quickly requires a combination of responsible credit management and focused actions. By paying bills on time, reducing your credit card balances, disputing any errors, and utilizing strategic methods like becoming an authorized user or increasing your credit limit, you can see significant improvements in a short period.

However, it’s important to remember that building and maintaining a good credit score is a long-term commitment. While these strategies can help you improve your score quickly, ongoing responsible financial habits are key to sustaining your progress and securing your financial future.

Start improving your credit score today and unlock the financial benefits of a strong credit profile.