Canada’s Foreign Direct Investment Plummets: A 20-Year Low

Has Capital Flight begun?

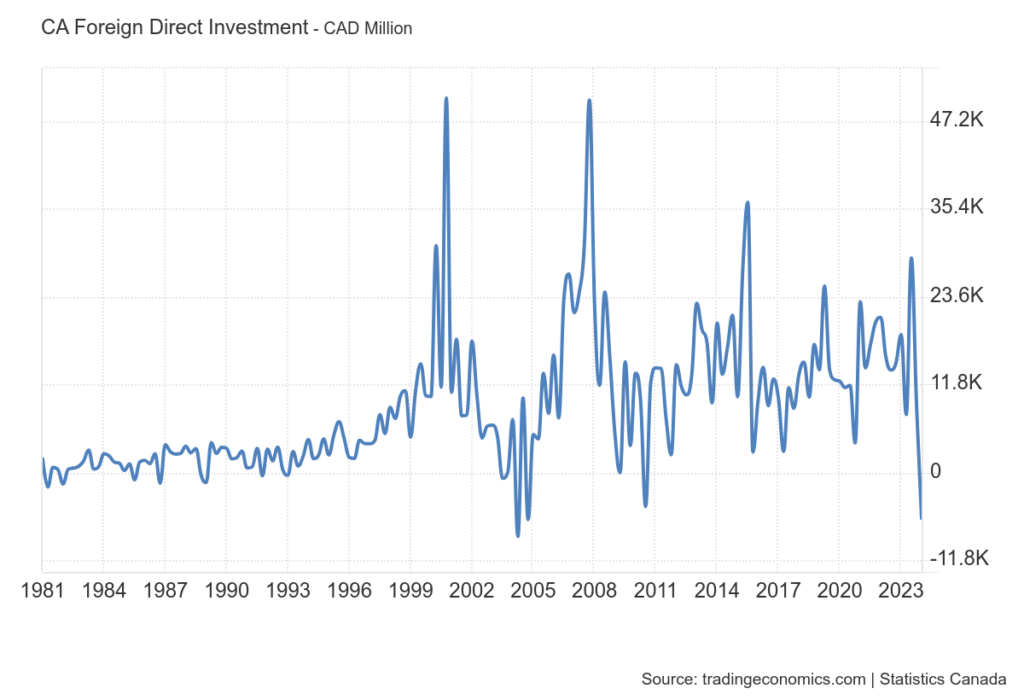

Canada is facing an alarming decline in foreign direct investment (FDI), hitting the lowest level in 20 years and turning negative for the first time since 2010. The country, known for its robust economy and attractive investment landscape, is now grappling with significant economic challenges that are reshaping its investment profile.

A Dismal Record

The latest data reveals a stark reality: Canada’s FDI has not only decreased but has also turned negative. This marks a departure from the steady inflow of investments that Canada has enjoyed for decades. According to Trading Economics, this troubling trend highlights a deeper issue within the nation’s economic framework.

The Root Causes: Unfriendly Business Environment and New Taxes

The primary culprits behind this downturn are an increasingly unfriendly business environment and the imposition of new taxes by the government. Over the past few years, regulatory hurdles have become more cumbersome, making it difficult for businesses to operate efficiently. These regulations, coupled with an array of new taxes, have significantly deterred foreign investors.

Investors seek environments where they can maximize returns with minimal bureaucratic obstacles. However, Canada’s current climate is perceived as hostile to business interests. This perception has been exacerbated by recent policy changes that impose additional financial burdens on businesses, diminishing the attractiveness of Canada as a destination for foreign capital.

Implications for Labour Productivity and Employment

The decline in FDI is not an isolated issue; it has broader implications for the Canadian economy, particularly concerning labour productivity and employment. Canada already struggles with low labour productivity compared to other advanced economies. Reduced investment means fewer resources are available for businesses to innovate, expand, and improve efficiency.

The ripple effect of diminished FDI is likely to lead to layoffs. Businesses facing financial strain due to lack of investment and increased operational costs may be forced to reduce their workforce to stay afloat. This potential wave of layoffs could further strain the economy, leading to higher unemployment rates and reduced consumer spending.

A Grim Outlook

The current trajectory suggests that Canada’s FDI situation is unlikely to improve in the near term. Without significant policy changes to create a more business-friendly environment and alleviate the tax burden on companies, foreign investors will continue to look elsewhere. This ongoing trend could exacerbate the existing challenges in Canada’s labour market and hinder economic growth.

In conclusion, Canada’s collapsing foreign direct investment signals deeper economic issues that need urgent attention. To reverse this trend, policymakers must focus on creating a more welcoming environment for businesses and reconsider the tax policies that are driving investors away. Without these changes, Canada risks enduring long-term economic stagnation and increased unemployment.