Will The BOC Make Everything Worse?

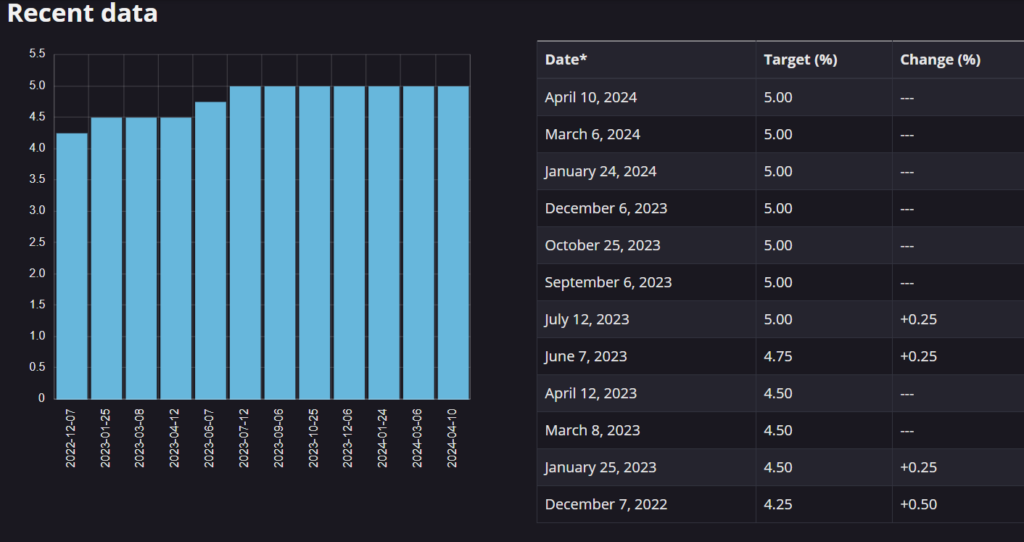

In the world of central banking, rate divergence between major economies, especially when they are close trading partners is a rarity, often signaling underlying economic complexities. Currently, such a scenario looms on the horizon as the Bank of Canada (BOC) contemplates rate cuts amidst slowing inflation, while the Federal Reserve (FED) in the United States leans towards rate hikes. This potential dissonance could have profound implications, particularly for Canada’s economic stability and its currency.

The Canadian economy finds itself at a critical juncture, with inflationary pressures easing and growth prospects waning. In response, the BOC is considering a reduction in interest rates to stimulate economic activity. However, juxtaposed against this, the FED is contemplating tightening monetary policy by raising rates to curb inflationary pressures.

Such a situation could precipitate a significant devaluation of the Canadian dollar (CAD). A downward adjustment in interest rates by the BOC would make Canadian assets less attractive to foreign investors, leading to a depreciation of the currency. This, in turn, could exacerbate inflationary pressures by making imports more expensive, further complicating the central banks’ policy decisions.

Moreover, a rate cut in Canada could exacerbate the already precarious levels of household debt. Canada has been grappling with soaring levels of household indebtedness, which far exceed those of other developed economies. The Canadian response to debt crises has often been to increase leverage, in stark contrast to the American approach of deleveraging post-2008 financial crisis.

The Canadian household debt-to-GDP ratio and household debt-to-income ratio stand among the highest globally, painting a concerning picture of overleverage and financial vulnerability. With a wave of bankruptcies and rising unemployment already straining the economy, further easing of monetary policy could fuel a dangerous cycle of overborrowing and financial instability.

In light of these challenges, the BOC’s decision to lower interest rates must be approached with caution. While intended to stimulate economic growth, such a move risks exacerbating existing imbalances and vulnerabilities within the Canadian economy. Instead of addressing the root causes of economic fragility, further rate cuts may merely serve to prolong and deepen the nation’s financial woes.

In conclusion, the divergence in monetary policy between the BOC and the FED underscores the complex challenges facing the Canadian economy. With inflationary pressures, household debt, and economic fragility already at alarming levels, a misstep in monetary policy could have far-reaching consequences. As the BOC deliberates its next move, careful consideration of the broader economic implications is imperative to safeguarding Canada’s financial stability and future prosperity.