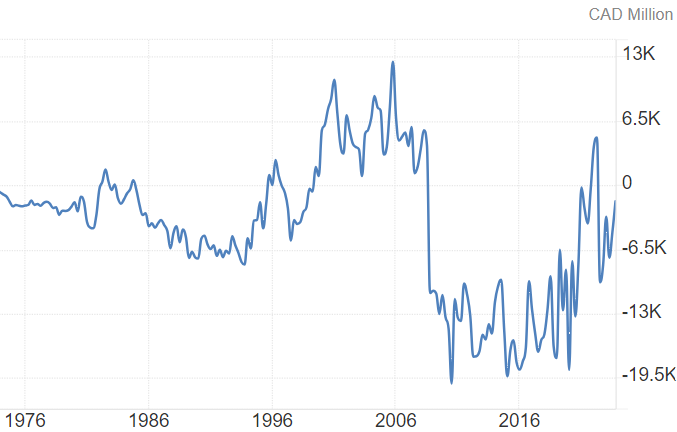

Canada’s Current Account Deficit Is Disappearing

As I delve into the economic landscape of my beloved Canada, one thing that has recently caught my attention since 2020 is the shrinking current account deficit. Now, let me tell you, it’s not every day that you witness such a significant shift in the economic tide. But before we delve deeper into the implications of this shrinkage, let’s first get our bearings straight and understand what exactly the current account deficit entails.

Here is how our government defines it:

“The current account is a record of a country’s international transactions with the rest of the world. It includes the trade balance (exports minus imports of goods), net income from abroad (such as interest and dividends), and net transfers (such as foreign aid). A surplus on the current account means that the country is earning more from its exports and investments abroad than it is spending on imports and payments to foreign investors. Conversely, a deficit on the current account means that the country is spending more on imports and payments to foreign investors than it is earning from exports and investments abroad.”

You see, when we talk about the balance of payments, there are various components to consider, but two primary ones stand out: the trade balance and the current account. Now, the trade balance, which measures the difference between exports and imports of goods, is what most folks tend to focus on when discussing international trade. It’s like keeping score in a game of economic prowess – if exports outweigh imports, you’re winning, and vice versa. Simple, right?

But here’s where it gets interesting – the current account takes a broader perspective. It not only considers trade in goods but also includes trade in services, investment income, and transfers. In essence, it gives a more comprehensive picture of a country’s international financial transactions. And let me tell you, this broader view is crucial, especially in today’s interconnected global economy.

Now, why do I say that the current account is better at indicating the activity of buying and selling Canadian dollars in the forex markets? Well, it’s simple – trade balance often overlooks important aspects such as services or foreign investment flows. Picture this: while goods may form the bulk of international trade, services like tourism, finance, or technology play a significant role too. And let’s not forget about investment income – those dividends and interest payments flowing in and out of the country are no small potatoes either.

So, here we are, witnessing Canada’s current account deficit shrinking. It’s a sight to behold, really. You see, levels haven’t been consistently this high since the early 2000s. And if memory serves me right, we haven’t seen such a recovery since the aftermath of the great recession in ’08/’09. It’s been a long road, filled with economic ups and downs, but it seems like we’re finally finding our footing again.

Now, let’s talk implications. What does a shrinking current account deficit mean for us Canucks? Well, for starters, it’s a sign of economic resilience. It indicates that our exports are picking up steam, our services are in demand, and our investments abroad are bearing fruit. It’s like a pat on the back for all the hard work we’ve put into diversifying our economy and strengthening our international ties.

But the benefits don’t stop there. Oh no, my friends. A shrinking current account deficit opens up a world of possibilities. For one, it can lead to a stronger Canadian dollar, making imports cheaper and boosting consumer purchasing power. And let’s not forget about the potential for increased foreign investment, which we get very little of these days, and many companies here need rather desperately. When the world sees that Canada is on the up and up, they’re more likely to park their money in our backyard, fueling further growth and prosperity.

Now, I can already hear some of you skeptics out there saying, “But what about the flip side? What if we end up with a multi-year surplus?” Well, my friends, let me tell you – that’s a problem I wouldn’t mind having. A surplus in the current account could mean lower borrowing costs for the government, as in also much easier to pay off the astronomical account of existing debt the country has, as well as increased savings and investment at home. It’s like having a little extra padding in your savings account – you never know when you might need it, but it sure feels good to have it there.

As we navigate these choppy economic waters, let’s not forget the lessons of the past. Let’s cherish this possibility moment of economic resurgence and use it as a springboard for future growth and prosperity. Together, we can build a brighter, more resilient Canada for generations to come.

References:

- Government of Canada Website: https://www150.statcan.gc.ca/n1/daily-quotidien/240228/dq240228b-eng.htm

- Trading Economics: https://tradingeconomics.com/canada/current-account