Canada’s Historic Wave Of Bankruptcies

Currently in Canada, I find myself looking through the uncharted waters of economic uncertainty in this country, considering not only the conclusion of the Canada Emergency Business Account (CEBA) loans program but also contending with the distressing surge in bankruptcies and the looming shadow of escalating unemployment. These recent developments have woven a complex tapestry of challenges, each thread interconnected and deeply impacting the livelihoods of countless Canadians.

The CEBA loans, once a beacon of hope amid the storm of the pandemic, served as a critical lifeline for businesses across the country. They provided the necessary financial bolster to weather the tempest, affording us the means to keep our operations running and our employees supported. Yet, as the repayment deadline drew near, the veil of uncertainty descended, casting a pall over the future of many small businesses.

According to recent insights from BNN Bloomberg, the Canadian Federation of Independent Business (CFIB) revealed a startling statistic: an estimated 200,000 small businesses resorted to acquiring new loans to meet the demands of the CEBA repayment deadline. This revelation underscores the pervasive financial strain plaguing businesses across the nation and underscores the urgency of the situation.

For many of us, the CEBA loans were not merely a temporary respite but a vital lifeline that sustained us through the most difficult periods of the pandemic. However, the prospect of repaying these loans amidst an uncertain economic climate has added an additional layer of complexity to an already challenging landscape.

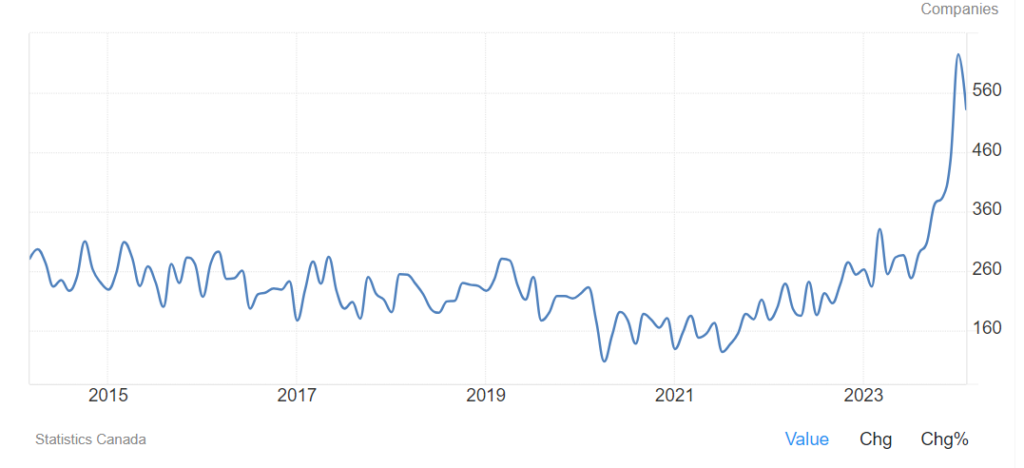

Compounding these concerns is the distressing surge in bankruptcies sweeping across Canada. As businesses grapple with the enduring aftermath of the pandemic, many find themselves teetering on the brink of collapse. The accompanying graph illustrates the alarming trajectory of bankruptcies in Canada, painting a sobering portrait of the economic devastation from the past few years.

Yet, amidst this sea of adversity, another storm looms on the horizon: rising unemployment. As businesses falter and shutter their doors, countless Canadians are left grappling with the harsh reality of job loss and financial insecurity. The ripple effects of this crisis are felt far and wide, with families struggling to make ends meet and communities grappling with the profound social and economic ramifications. Increasingly the biggest employer is by far the public service sector.

Now, more than ever, we require support from our government, our communities. We need policies and programs that prioritize the needs of small businesses and provide the resources necessary to ensure our survival. Moreover, we must confront the scourge of rising unemployment head-on, implementing measures to support those who find themselves displaced amidst these turbulent times.

I personally remain hopeful that, we can inevitably overcome the obstacles before us and emerge stronger and more resilient than ever before.

Reference: